“I need coverage.”

Whether you’re paying off your home mortgage or protecting your employees’ welfare, we have insurance products that fit your needs.

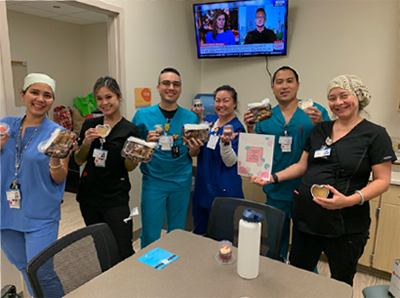

Connected With Our Community

Showing our appreciation for local healthcare professionals with a nice lunch.

Supporting charitable causes, including participation in the annual Hawaii Lodging Charity Walk.

We’re committed to realizing a sustainable and hopeful society by moving toward a digital environment that will dramatically reduce our carbon footprint.

Our commitment to developing sustainable practices now will benefit future generations.